Empowering Technology & Innovation with Essential Rare Earths

Securing America’s Defense: Unlocking Independent Supply Chains for National Security

Critical Metals Corp. is the emerging leader in rare earth supply.

As one of the few companies advancing a fully integrated rare earth supply chain outside of China, Critical Metals Corp. is developing world-class capabilities from resource extraction and processing to advanced materials manufacturing.

Our operations in Greenland unlock one of the richest untapped rare earth deposits in the world, the Tanbreez Project, with a commitment to responsible development and local engagement. By utilizing hydro-electric power, Tanbreez is expected to be one of the greenest mining operations in the world, if not the most.

These essential materials power critical industries, from clean energy and electric mobility to defense, aerospace, robotics, and advanced technologies- enabling high-tech assets, accelerating innovation, and driving the global Energy Transition. With China’s stronghold over these materials, the West needs to diversify its supply chain – Critical Metals Corp. is the solution.

Applications

Defense & Aerospace

Rare earths are critical in advanced military technologies. The US Department of Defense has declared rare earths as a strategic material, vital for systems like radar, missile guidance, and secure communications.

Consumer Electronics

Smartphones, tablets, and computers rely on rare earths for high-efficiency magnets, screens, and other components. The global market for electronics will continue to grow with projections of over 1.5 billion smartphones sold annually by 2027.

Electric Vehicles (EVs)

The automotive industry is a major consumer of rare earths, with neodymium, dysprosium, and praseodymium used in electric vehicle motors. The global EV market is expected to reach over 40 million vehicles by 2030, significantly increasing demand for these critical metals.

Wind Energy

About 2-3 tons of rare earths are required per megawatt of installed capacity in offshore wind turbines. With the expansion of wind energy, demand for rare earths like neodymium and dysprosium will increase.

Medical Technologies

MRI machines, X-ray imaging, and cancer treatments use various rare earth isotopes for imaging and radiotherapy.

Mining Operations

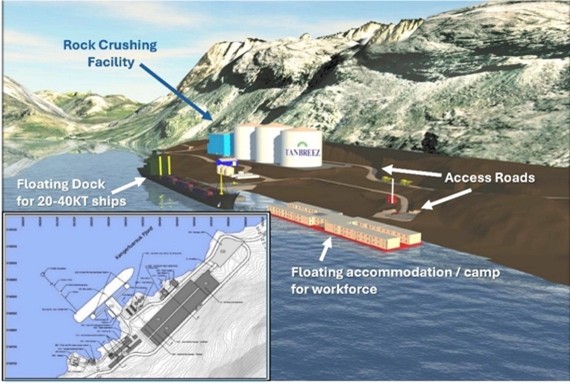

Operational Concept: Incredibly simple mining and logistic solution:

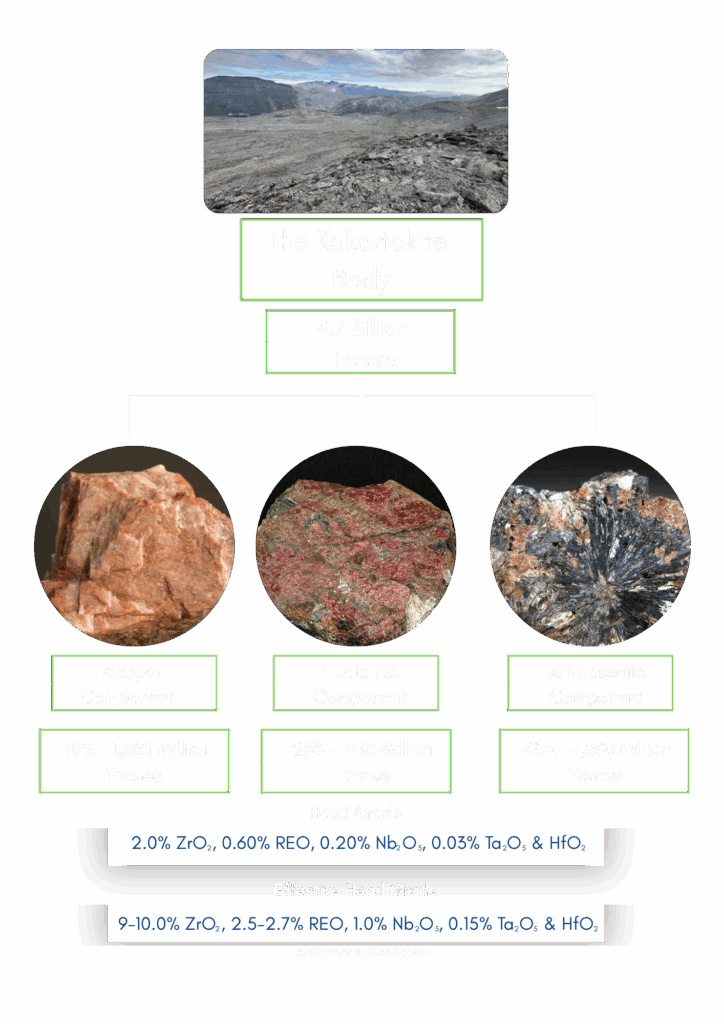

An open pit mine with onsite dry magnetic separation and a floating dock to load ore directly onto ships as the mine sits alongside a 200-foot-deep fjord in which large carriers can operate. There are three distinct components, feldspar, arfvedsonite, and eudialyte.

The mine will sell the first two for construction materials, making the mine profitable. The Heavy Rare Earth Elements (HREE) and other key minerals are contained in the eudialyte with an average grade of 0.4% total Rare Earth Oxides that include 27% HREE, one of the highest concentrations in the world. The fjord is ice-free year-round, the temperatures in winter are low 30’s to high 20’s Fahrenheit, and in summer are in the 50’s Fahrenheit. Ships leave the fjord to go directly to North America or Europe without transiting a choke point.

Components

Tanbreez contains a significant percentage of the global supply of critical minerals restricted by China:

Yttrium (45%), terbium (45%), dysprosium (62%), gadolinium (35%), lutetium (80%), and samarium (19%); also notable for its high concentrations of zirconium (Zr), niobium (Nb), tantalum (Ta), hafnium (Hf), gallium (Ga); majority of the global supply of zirconium metal, which is critical for hypersonic weapons and is relatively easy to extract from this type of ore.

Sustainability Efforts

At Critical Metals Corp., we recognize the vital role that rare earth elements (REEs) play in defense applications, the global transition to clean energy, and technological advancement.

However, we also understand the responsibility we carry in sourcing these materials in an environmentally and socially responsible manner.

As we develop Greenland’s Tanbreez rare earth deposit, we are committed to implementing sustainable practices at every stage of our operations, from exploration and extraction to processing and community engagement.

News

-

Critical Metals Corp. Proudly Announces the Highest Re-Assay TREO Results From Inception From (33) Drill Holes Results

Also Indicates Massive Geological Upside at the Hill Deposit at Flagship Tanbreez Heavy REE Project in Greenland…

-

Critical Metals Corp. Nasdaq-CRML Announces Multiple Extensions to Known Resources & Multiple New Ultra High-Grade Mineralization Results of 27.0% Heavy REE’s for the 2025 Drilling Campaign for Area B, Fjord & Others with Immediate Near-Term Growth Potential & 2026 Drilling Target Selection

NEW YORK, Feb. 09, 2026 (GLOBE NEWSWIRE) — Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or…

-

Austrian Government Extends Critical Metals Corp’s Wolfsberg Mining License

NEW YORK, Jan. 30, 2026 (GLOBE NEWSWIRE) — Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or…